Long-term forex trading strategies set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Fundamental and technical analysis techniques, coupled with risk management and a well-thought-out trading plan, form the pillars of success in the forex market.

Introduction to Long-term Forex Trading Strategies

Long-term forex trading strategies refer to approaches in the foreign exchange market that involve holding positions for an extended period, typically weeks, months, or even years. Unlike short-term trading, which focuses on making quick profits from small price movements, long-term strategies aim to capitalize on larger market trends and fluctuations.

Importance of Having a Long-term Approach in Forex Trading

Having a long-term approach in forex trading is crucial for several reasons. Firstly, it allows traders to avoid the noise and volatility of short-term fluctuations, enabling them to make more informed decisions based on broader market trends. Additionally, long-term strategies help traders ride out temporary setbacks and losses, as they are focused on the bigger picture rather than day-to-day fluctuations.

Understand how the union of Understanding cryptocurrency volatility can improve efficiency and productivity.

Benefits of Long-term Strategies over Short-term Ones

- Reduced Stress: Long-term trading minimizes the need to constantly monitor positions, reducing stress and emotional decision-making.

- Higher Profit Potential: Long-term strategies have the potential for larger profits as they aim to capture major market trends.

- Less Transaction Costs: Long-term traders incur fewer transaction costs compared to frequent trading, which can eat into profits.

- Time Efficiency: Long-term trading allows traders to spend less time analyzing charts and more time focusing on overall market trends and developments.

Fundamental Analysis in Long-term Forex Trading

Fundamental analysis is a crucial component of long-term forex trading strategies, as it helps traders assess the intrinsic value of a currency and make informed decisions based on economic indicators and factors.

When engaging in long-term forex trading, traders consider a range of fundamental factors that can impact currency valuations over an extended period. Some of the key fundamental factors include interest rates, inflation rates, economic growth, political stability, and geopolitical events. By analyzing these factors, traders can gain insights into the overall health of an economy and make predictions about the future direction of a currency’s value.

Role of Economic Indicators

Economic indicators play a significant role in long-term forex trading decisions. These indicators provide valuable insights into the health of an economy and can help traders anticipate future trends in currency valuations. Some common economic indicators that traders closely monitor include Gross Domestic Product (GDP), employment data, inflation rates, trade balances, and consumer confidence indices.

Traders often use economic indicators to gauge the overall strength of an economy and identify potential trading opportunities. For example, a strong GDP growth rate may signal a robust economy and lead to an appreciation of the country’s currency. Conversely, high inflation rates or rising unemployment levels could indicate economic instability and potential currency depreciation.

In conclusion, fundamental analysis and the consideration of economic indicators are essential components of long-term forex trading strategies. By analyzing these factors and staying informed about key economic developments, traders can make informed decisions and position themselves for success in the forex market over the long term.

Technical Analysis Techniques for Long-term Forex Trading

Technical analysis plays a crucial role in long-term forex trading strategies as it helps traders identify trends and make informed decisions based on historical price movements. By using various technical indicators, traders can analyze market data and predict future price movements.

Comparison of Different Technical Indicators for Long-term Trading

There are several technical indicators that are commonly used in long-term forex trading to identify trends and potential entry/exit points. Some of the popular technical indicators include:

- Moving Averages: Moving averages help smooth out price data to identify trends over a specified period. Traders often use a combination of moving averages to confirm trends.

- Relative Strength Index (RSI): RSI is a momentum oscillator that measures the speed and change of price movements. It helps traders identify overbought or oversold conditions in the market.

- MACD (Moving Average Convergence Divergence): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It helps traders identify the strength of a trend.

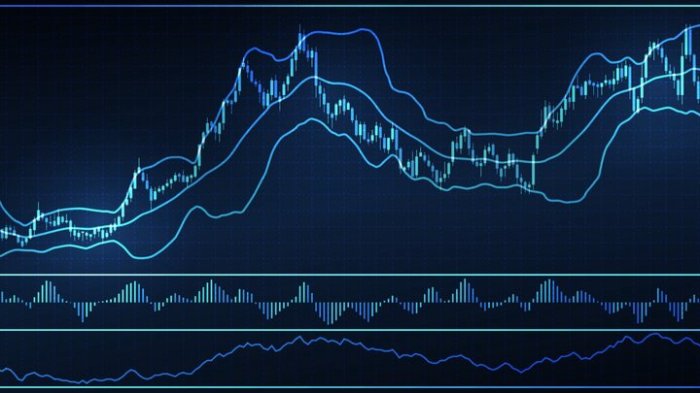

- Bollinger Bands: Bollinger Bands consist of a simple moving average and two standard deviations plotted above and below the moving average. They help traders identify volatility and potential reversal points.

Identifying Long-term Trends using Technical Analysis

Identifying long-term trends in the forex market is essential for successful trading. Traders can use technical analysis tools like trendlines, moving averages, and MACD to identify and confirm trends. By analyzing historical price data and monitoring key technical indicators, traders can make informed decisions on when to enter or exit trades based on long-term trends.

Risk Management in Long-term Forex Trading

When it comes to long-term forex trading strategies, risk management plays a crucial role in ensuring the overall success of your trades. By implementing effective risk management techniques, you can protect your capital and maximize your potential for profitability over the long term.

Setting Stop-Loss Levels in Long-term Trades

Setting appropriate stop-loss levels is essential in long-term forex trading to limit potential losses and protect your investment. It is important to determine a stop-loss level based on your risk tolerance and the volatility of the market. A common approach is to set stop-loss orders at a certain percentage below the entry price to minimize downside risk while allowing for potential market fluctuations.

Position Sizing and Risk-Reward Ratios for Long-term Positions

Position sizing is a critical aspect of risk management in long-term forex trading. By determining the appropriate position size based on your account size and risk tolerance, you can effectively manage your exposure to potential losses. Additionally, calculating the risk-reward ratio for each trade can help you assess the potential profitability relative to the risk involved. A favorable risk-reward ratio can enhance the overall success of your long-term trading strategy.

Developing a Long-term Trading Plan: Long-term Forex Trading Strategies

Creating a comprehensive long-term trading plan is crucial for success in the forex market. It involves setting specific goals, strategies, and risk management techniques to guide your trading decisions over an extended period.

Setting Realistic Goals, Long-term forex trading strategies

- Define your financial objectives: Determine how much profit you aim to make over a certain period and set achievable targets.

- Consider your risk tolerance: Assess how much you are willing to risk per trade and set realistic expectations based on your risk appetite.

- Establish a timeframe: Decide on the duration of your trades and align your goals accordingly to avoid setting unrealistic expectations.

Sticking to a Long-term Trading Plan

- Follow your plan diligently: Stick to the strategies and rules Artikeld in your trading plan without deviating based on emotions or market fluctuations.

- Review and adapt: Regularly review your trading plan to adjust to changing market conditions and improve your strategies over time.

- Stay disciplined: Avoid making impulsive decisions by staying disciplined and adhering to your long-term trading plan, even during challenging times.

In conclusion, Long-term forex trading strategies provide a roadmap to sustainable success in the forex market. By combining patience, analysis, and strategic planning, traders can navigate the complexities of long-term trading with confidence and precision.