Automated forex trading systems have completely transformed the way we trade in the Forex market, offering unparalleled efficiency and precision. Dive into the world of automated trading as we explore the ins and outs of this groundbreaking technology.

Introduction to Automated Forex Trading Systems

Automated forex trading systems are computer programs that are designed to analyze the forex market, make trading decisions, and execute trades on behalf of the trader. These systems operate based on pre-set rules and algorithms, removing the need for manual intervention in the trading process.

Automated trading systems offer several benefits to forex traders. Firstly, they can execute trades with high speed and accuracy, eliminating the potential for human error. Secondly, these systems can operate 24/7, allowing traders to take advantage of trading opportunities in different time zones. Additionally, automated trading systems can backtest trading strategies using historical data, helping traders optimize their strategies for better results.

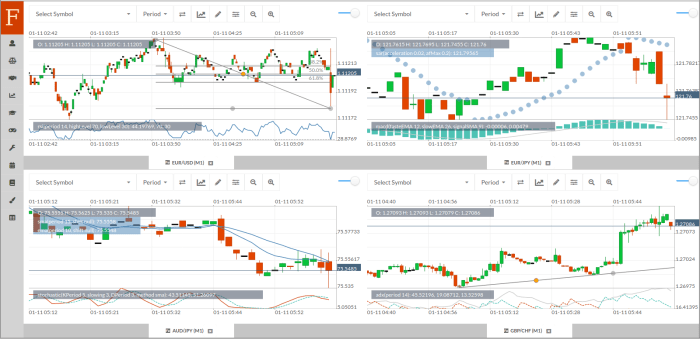

Some popular automated forex trading systems in the market include MetaTrader, NinjaTrader, and TradeStation. These platforms offer a wide range of features such as algorithmic trading, custom indicators, and automated trade execution, making them popular choices among forex traders looking to automate their trading activities.

How Automated Forex Trading Systems Work

Automated forex trading systems operate by utilizing algorithms and software to execute trades in the forex market without the need for manual intervention. These systems analyze market conditions and make trading decisions based on predefined criteria.

Execution of Trades

Automated trading systems are programmed to automatically place buy or sell orders in the forex market when certain conditions are met. These conditions can include specific price levels, technical indicators, or other parameters set by the trader.

Role of Algorithms and Software

Algorithms play a crucial role in automated trading systems by processing vast amounts of market data and identifying potential trading opportunities. These algorithms are designed to follow a set of rules and criteria to execute trades efficiently and effectively.

Market Analysis and Decision-Making

Automated systems constantly analyze market conditions, such as price movements, volume, and volatility, to determine the best times to enter or exit trades. By using historical data and real-time information, these systems can make informed trading decisions without emotions or human bias.

Advantages of Automated Forex Trading Systems

Automated forex trading systems offer several advantages over manual trading. These systems utilize advanced algorithms to execute trades on behalf of the trader, providing speed, accuracy, and emotion-free decision-making.

Speed and Accuracy

Automated trading systems can analyze market conditions and execute trades in a matter of milliseconds, much faster than human traders. This speed is crucial in a fast-paced market where prices can change rapidly. Moreover, automated systems can execute trades with precision and consistency, eliminating the potential for human error.

Minimizing Emotions in Trading, Automated forex trading systems

One of the biggest advantages of automated forex trading systems is their ability to minimize emotions in trading. Emotions such as fear, greed, and hesitation can often cloud a trader’s judgment and lead to poor decision-making. Automated systems operate based on predefined criteria and rules, eliminating the influence of emotions on trading decisions. This helps traders stick to their trading strategy and avoid impulsive decisions that can result in losses.

Risks and Challenges of Automated Forex Trading Systems

Automated forex trading systems offer convenience and efficiency, but they also come with their own set of risks and challenges that traders need to be aware of. Understanding these potential pitfalls is crucial for successful trading in the forex market.

Potential Risks of Automated Trading

Automated forex trading systems rely on algorithms and pre-set conditions to execute trades, which means they are susceptible to technical failures or glitches. These systems may not always account for sudden market changes or unexpected events, leading to potential losses. Additionally, automated trading can be impacted by poor internet connection, power outages, or server issues, which could disrupt trading activities.

Challenges Traders May Face

One of the main challenges traders face when relying solely on automated trading is the lack of human judgment and intuition. Automated systems may not always be able to adapt to changing market conditions or make quick decisions based on current events. Traders may also struggle with system errors or bugs that can result in significant financial losses if not addressed promptly.

Strategies to Mitigate Risks and Overcome Challenges

To mitigate the risks associated with automated forex trading systems, traders should regularly monitor their systems for any signs of malfunction or errors. It is essential to have a backup plan in place in case of technical issues or system failures. Additionally, traders should diversify their trading strategies and not rely solely on automated systems for all their trades. Using a combination of manual and automated trading can help reduce risks and improve overall trading performance.

In conclusion, automated forex trading systems have revolutionized the trading landscape, offering traders a powerful tool to navigate the complex world of Forex with ease. Embrace automation and take your trading to new heights today.

Find out about how Best forex trading robots can deliver the best answers for your issues.