Forex leverage explained: Dive into the world of trading with leverage, where opportunities and risks collide to shape your financial journey.

Leverage in Forex trading offers a unique way for traders to amplify their capital, but it comes with its own set of challenges and considerations.

What is Forex leverage?: Forex Leverage Explained

Forex leverage is a tool that allows traders to control larger positions with a smaller amount of capital. It essentially enables traders to amplify their potential returns by using borrowed funds from their broker.

Significance of Forex leverage in trading, Forex leverage explained

- Leverage provides traders with the ability to enter larger positions than they would be able to with their own capital alone.

- It allows traders to potentially increase their profits significantly, as gains are calculated based on the total position size.

- However, leverage also magnifies losses, which can lead to significant financial risks if not managed properly.

Risks and rewards of using leverage in Forex trading

- One of the main risks of using leverage is the potential for substantial losses, especially if the market moves against the trader’s position.

- On the other hand, the rewards of leverage include the ability to generate higher profits with a smaller initial investment.

- Traders must be cautious when using leverage and implement risk management strategies to protect their capital from significant drawdowns.

Understanding leverage ratios

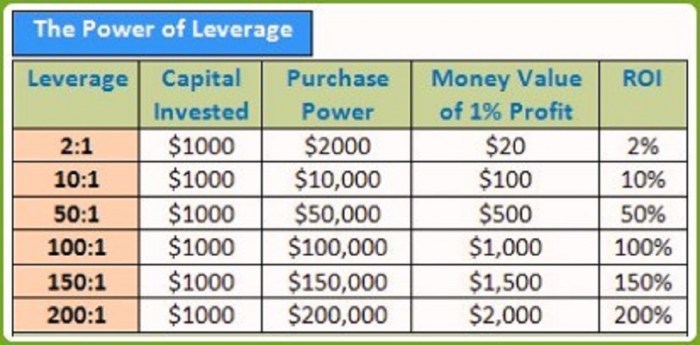

When trading in the Forex market, leverage ratios play a crucial role in determining the amount of capital required to open a position. Leverage allows traders to control larger positions with a smaller amount of capital, amplifying both potential profits and losses.

Find out further about the benefits of How to trade forex successfully that can provide significant benefits.

Common Leverage Ratios

In Forex trading, common leverage ratios include 50:1, 100:1, and 500:1. These ratios indicate the multiple by which a trader’s position is magnified compared to their initial investment. For example, a 100:1 leverage ratio means that for every $1 in the trader’s account, they can control a position worth $100.

- 50:1 Leverage Ratio: This ratio allows traders to control positions 50 times the size of their capital. While it offers more leverage than traditional stock trading, it also exposes traders to higher risks.

- 100:1 Leverage Ratio: With this ratio, traders can control positions 100 times larger than their capital. While it provides the potential for higher profits, it also increases the risk of significant losses.

- 500:1 Leverage Ratio: This ratio offers the highest level of leverage, allowing traders to control positions 500 times the size of their capital. While it can lead to substantial profits, it also comes with extreme risk due to the amplified exposure.

Impact of Leverage Ratios on Trading Strategies

The choice of leverage ratio significantly impacts trading strategies. Higher leverage ratios can amplify both gains and losses, making them suitable for experienced traders with a high-risk tolerance. In contrast, lower leverage ratios provide a more conservative approach, limiting potential profits but also reducing the risk of significant losses.

Margin requirements and leverage

Margin requirements and leverage are closely intertwined in Forex trading, playing a significant role in determining the amount of capital a trader can control in the market. Let’s delve deeper into how margin levels impact leverage and the implications for traders.

Relationship between margin requirements and leverage

Margin requirements specify the minimum amount of funds a trader must have in their account to open and maintain a trading position. Leverage, on the other hand, allows traders to control a larger position size with a smaller amount of capital. The relationship between margin requirements and leverage lies in the fact that leverage amplifies both potential profits and losses. As leverage increases, margin requirements decrease, enabling traders to take larger positions with a smaller initial investment. However, this also exposes traders to higher risk due to the magnified impact of price movements on their account balance.

Impact of margin levels on leverage

Margin levels indicate the percentage of a trader’s account balance that is being used to secure open positions. As margin levels decrease, traders have access to higher leverage, allowing them to control larger positions relative to their account size. Conversely, as margin levels increase, leverage decreases, limiting the size of positions traders can take. It is essential for traders to monitor their margin levels closely, as falling below the required margin level can lead to a margin call.

Margin calls in leveraged trading

A margin call occurs when a trader’s account equity falls below the required margin level to support their open positions. In leveraged trading, margin calls are triggered to protect brokers from losses and ensure that traders have sufficient funds to cover potential losses. When a margin call is issued, traders are typically required to deposit additional funds into their account to meet the margin requirements and avoid position liquidation. Managing margin calls effectively is crucial for traders to prevent account blowouts and preserve capital in leveraged trading scenarios.

Risks and considerations

When it comes to trading Forex with leverage, there are significant risks that traders need to be aware of. High leverage can amplify both profits and losses, making it a double-edged sword in the trading world.

Potential risks of high leverage

- Increased risk of significant losses: High leverage means that even small price movements can lead to substantial losses.

- Magnified impact of market volatility: Volatile market conditions can result in rapid and extreme price fluctuations, potentially wiping out an account with high leverage.

- Margin calls and liquidation: If a trade moves against a trader, they may be required to deposit additional funds to meet margin requirements or risk having their positions forcibly closed.

- Psychological pressure: The added stress of managing high leverage positions can lead to emotional decision-making, which may result in poor trading choices.

Risk management strategies

- Set stop-loss orders: Implementing stop-loss orders can help limit potential losses by automatically closing a trade at a predetermined price level.

- Diversify your portfolio: Avoid putting all your capital into one high-leverage trade; instead, spread your risk across multiple trades and asset classes.

- Use proper position sizing: Calculate the appropriate position size based on your account balance and risk tolerance to prevent overexposure to high leverage.

- Stay informed and educated: Keep yourself updated on market news and trends to make informed trading decisions and avoid impulsive actions based on leverage.

Tips for traders

- Start with a demo account: Practice trading with leverage in a risk-free environment before committing real funds to gain experience and confidence.

- Understand your risk tolerance: Be honest about how much risk you can comfortably handle and adjust your leverage accordingly.

- Stick to a trading plan: Develop a well-thought-out trading strategy and adhere to it, even when the temptation to use high leverage arises.

- Seek professional advice: Consider consulting with a financial advisor or mentor who can provide guidance on risk management techniques and leverage usage.

In conclusion, navigating the realm of Forex leverage requires a balance of caution and strategy to maximize profits while minimizing risks.