Day trading strategies in forex set the stage for rapid trades and quick profits, making it a dynamic and exciting approach in the forex market. Dive into the world of fast-paced trading with this comprehensive guide.

Technical indicators, fundamental analysis, risk management, and trading plans are just a few of the key components that will be explored in depth, providing you with the tools needed to succeed in day trading.

Overview of Day Trading Strategies in Forex

Day trading in the forex market involves buying and selling currency pairs within the same trading day to profit from short-term price movements. It requires quick decision-making, technical analysis skills, and the ability to manage risk effectively.

Popular Day Trading Strategies

- Scalping: This strategy involves making numerous small trades throughout the day to capitalize on small price movements. Traders aim to make a profit quickly and exit positions within minutes or seconds.

- Breakout Trading: Traders look for significant price movements or breakouts from a defined range. They enter positions when the price breaks above resistance levels or below support levels.

- Trend Trading: This strategy involves identifying and following the prevailing market trend. Traders enter positions in the direction of the trend and ride the momentum until signs of a reversal appear.

- Range Trading: Traders identify a range-bound market where the price fluctuates between support and resistance levels. They buy at support and sell at resistance, aiming to profit from the price oscillations.

Importance of Day Trading Strategies

Day trading strategies are crucial for success in forex trading as they help traders navigate the volatile and fast-paced nature of the market. These strategies provide a systematic approach to trading, helping traders make informed decisions based on technical analysis, market conditions, and risk management techniques.

Technical Analysis Strategies

When it comes to day trading in the forex market, technical analysis plays a crucial role in helping traders make informed decisions. By analyzing historical price data and market trends, traders can identify potential entry and exit points for their trades. Let’s explore some common technical analysis strategies used by forex day traders.

Common Technical Indicators

Technical indicators are mathematical calculations based on historical price, volume, or open interest data. These indicators help traders analyze market trends, momentum, volatility, and potential reversals. Some common technical indicators used in forex day trading include:

- Moving Averages: Moving averages smooth out price data to identify trends over a specific period. Traders often use moving averages to determine the direction of the trend and potential support or resistance levels.

- Relative Strength Index (RSI): The RSI is a momentum oscillator that measures the speed and change of price movements. Traders use the RSI to identify overbought or oversold conditions in the market.

- Bollinger Bands: Bollinger Bands consist of a middle band (simple moving average) and two outer bands that represent volatility. Traders use Bollinger Bands to identify potential price breakouts and reversals.

- MACD (Moving Average Convergence Divergence): The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. Traders use the MACD to identify changes in trend direction.

Chart Patterns

Chart patterns are formations that occur on price charts and provide valuable insight into potential market movements. Day traders often use chart patterns to identify trends, reversals, and continuation patterns. Some common chart patterns utilized by day traders include:

- Head and Shoulders: A reversal pattern that indicates a potential change in trend direction.

- Double Top/Bottom: A reversal pattern that signals a potential trend reversal after reaching a price peak or trough twice.

- Cup and Handle: A continuation pattern that suggests a brief consolidation before the trend resumes.

- Triangle Patterns: Continuation patterns that indicate a potential breakout or breakdown in price.

Support and Resistance Levels

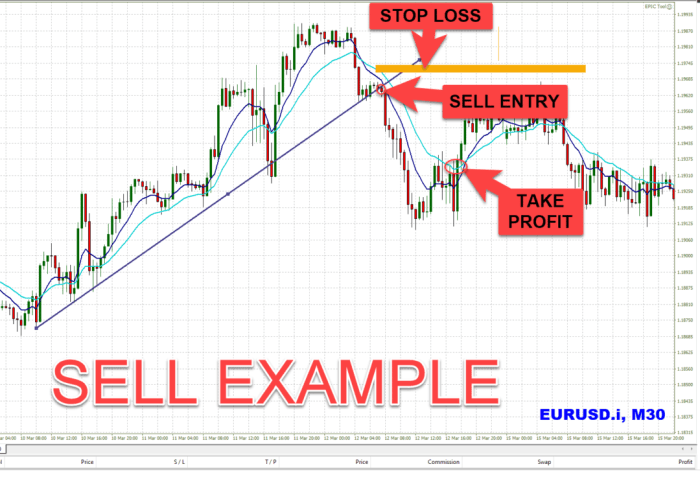

Support and resistance levels are key areas where price tends to react. Support levels act as a floor for price, preventing it from falling further, while resistance levels act as a ceiling, preventing price from rising higher. Traders can use support and resistance levels to identify potential entry and exit points, as well as to set stop-loss and take-profit levels for their trades. By understanding these levels, traders can make more informed decisions based on the price action of the currency pair they are trading.

Fundamental Analysis in Day Trading

When it comes to day trading in the forex market, fundamental analysis plays a crucial role in helping traders make informed decisions based on economic indicators and news events.

Role of Economic Indicators

Economic indicators such as GDP, inflation rates, employment data, and central bank interest rates provide valuable insights into the overall health of a country’s economy. Traders use this information to gauge the strength of a currency and make trading decisions accordingly.

- For example, a strong GDP growth rate may indicate a robust economy, leading to increased demand for the country’s currency.

- On the other hand, high inflation rates could erode the value of a currency, making it less attractive to investors.

Impact of News Events

News events, such as central bank announcements, geopolitical developments, and economic reports, can have a significant impact on currency prices. Traders need to stay informed about these events to anticipate market reactions and adjust their trading strategies accordingly.

- For instance, if a central bank signals a potential interest rate hike, it could lead to a strengthening of the country’s currency.

- On the other hand, political instability or negative economic data could cause a currency to weaken.

Incorporating Fundamental Analysis

Traders can incorporate fundamental analysis into their day trading strategies by combining economic indicators with technical analysis. By analyzing both the macroeconomic factors and price charts, traders can gain a more comprehensive understanding of market trends and make more informed trading decisions.

- For example, if economic data suggests a country’s economy is weakening, traders may look for technical signals that confirm a potential downtrend in the currency.

- Conversely, positive economic indicators could align with bullish technical patterns, providing a strong signal to enter a long position.

Risk Management Techniques

Effective risk management is crucial for day traders in forex to protect their capital and maximize profits. It involves various strategies to minimize potential losses and ensure long-term success. Setting stop-loss and take-profit levels, as well as managing position sizing and leverage, are key aspects of risk management in day trading.

Setting Stop-Loss and Take-Profit Levels

Setting stop-loss and take-profit levels is essential to manage risk and protect capital in day trading. Stop-loss orders help limit potential losses by automatically closing a trade at a predetermined price level. Take-profit orders, on the other hand, lock in profits by closing a trade when a specific profit target is reached. By setting these levels before entering a trade, traders can control their risk exposure and avoid emotional decision-making during volatile market conditions.

Position Sizing and Leverage

Proper position sizing is critical in risk management to ensure that traders do not risk too much of their capital on a single trade. By determining the appropriate position size based on risk tolerance and account size, traders can limit the impact of potential losses on their overall portfolio. Leverage, which allows traders to control larger positions with a smaller amount of capital, can amplify both profits and losses. It is important to use leverage wisely and consider the risk-reward ratio before entering a trade to avoid excessive risk-taking and potential margin calls.

Developing a Trading Plan: Day Trading Strategies In Forex

Having a solid trading plan is crucial for success in day trading forex. It provides a roadmap for your trades, helps you stay focused, and ensures you have a disciplined approach to the market.

Components of a Comprehensive Day Trading Plan

- Entry and exit rules: Clearly define the conditions for entering and exiting trades.

- Risk management strategy: Determine how much you are willing to risk on each trade.

- Trade size and position sizing: Decide on the size of your positions based on your risk tolerance.

- Trading hours: Set specific times for trading to avoid overtrading.

- Monitoring and evaluation: Regularly review your trades to learn from successes and failures.

Tips for Setting Realistic Goals and Objectives, Day trading strategies in forex

- Set achievable goals based on your experience and risk appetite.

- Avoid setting unrealistic profit targets that may lead to impulsive decisions.

- Focus on consistency and gradual growth rather than aiming for quick profits.

- Regularly review and adjust your goals as you progress in your trading journey.

Importance of Discipline and Consistency

- Discipline helps you stick to your trading plan and avoid emotional decision-making.

- Consistency in following your plan builds trust in your strategy and improves your overall performance.

- Developing good habits and routines will lead to long-term success in day trading forex.

As you navigate the world of day trading strategies in forex, remember that knowledge and strategy are your best allies. With the right approach and discipline, you can harness the potential of quick trades to achieve your financial goals.

When investigating detailed guidance, check out Forex trading for beginners now.