Crypto staking explained takes center stage, beckoning readers into a world of financial opportunities. Staking your cryptocurrencies can be a lucrative venture, offering rewards and benefits that go beyond traditional investment methods. Dive into this comprehensive guide to understand the ins and outs of crypto staking.

What is Crypto Staking?

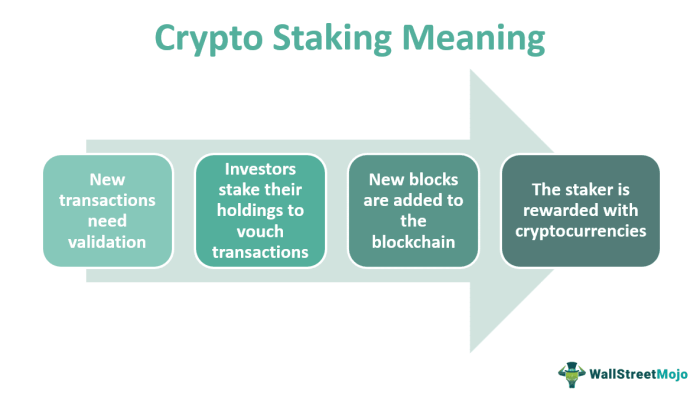

Cryptocurrency staking is a process where users hold a certain amount of digital assets in a compatible wallet to support the operations of a blockchain network. In return for staking their coins, participants receive rewards in the form of additional cryptocurrencies. This method helps secure the network, validate transactions, and achieve consensus without the need for powerful mining equipment.

Popular Cryptocurrencies Supporting Staking

- Ethereum (ETH): Ethereum is transitioning to a proof-of-stake (PoS) model with the Ethereum 2.0 upgrade, allowing users to stake their ETH and earn rewards.

- Cardano (ADA): Cardano’s PoS network enables users to stake ADA coins to help validate transactions and earn staking rewards.

- Tezos (XTZ): Tezos uses a liquid PoS consensus mechanism where users can delegate their XTZ tokens to bakers and receive staking rewards.

Benefits of Staking for Investors

- Passive Income: Staking provides a way for investors to earn passive income by holding their cryptocurrency assets.

- Network Security: Stakers contribute to the security and decentralization of the blockchain network by participating in the staking process.

- Token Rewards: Staking rewards investors with additional tokens or coins, incentivizing them to hold their assets and support the network.

Difference Between Staking and Mining

Staking and mining are both mechanisms to validate transactions on a blockchain, but they differ in how they achieve consensus and reward participants. While mining requires solving complex mathematical problems using computational power, staking involves holding coins in a wallet to participate in block validation. Stakers are chosen to create new blocks based on the number of coins they hold and their willingness to support the network, whereas miners compete to solve cryptographic puzzles for block rewards.

How Does Crypto Staking Work?

Cryptocurrency staking involves actively participating in the blockchain network by holding cryptocurrencies in a wallet to support the network’s operations. In return, stakers receive rewards for their contribution to network security and integrity.

The Process of Staking Cryptocurrencies

Staking cryptocurrencies typically involves locking up a certain amount of coins in a digital wallet to participate in the network’s consensus mechanism. This process helps secure the network and validate transactions, similar to how miners secure proof-of-work blockchains.

- Stakers are chosen to create new blocks or validate transactions based on the number of coins they hold and the length of time they have been staking.

- Validators are responsible for verifying transactions and adding them to the blockchain. They play a crucial role in maintaining network security and integrity.

- Staking rewards are distributed among participants based on their contribution to the network. The more coins staked, the higher the potential rewards.

Requirements for Starting Staking, Crypto staking explained

To start staking cryptocurrencies, individuals need to have a compatible digital wallet that supports staking and hold a minimum amount of the specific cryptocurrency. Additionally, a stable internet connection is essential to ensure continuous participation in the staking process.

The Role of Validators in Staking

Validators are essential participants in the staking process as they validate transactions and secure the network. By staking their coins and actively participating in the consensus mechanism, validators help maintain the integrity and security of the blockchain network.

Risks Involved in Staking and Mitigation Strategies

Staking cryptocurrencies comes with certain risks, including potential loss of staked coins due to network attacks or software vulnerabilities. To mitigate these risks, stakers can choose reputable staking pools, diversify their staking investments, and stay informed about network updates and security measures.

Types of Crypto Staking

When it comes to crypto staking, there are different types of mechanisms that users can participate in to earn rewards. Two popular staking mechanisms are Proof of Stake (PoS) and Delegated Proof of Stake (DPoS). Let’s delve into the details of each.

Proof of Stake (PoS)

Proof of Stake (PoS) is a consensus algorithm where validators are chosen to create new blocks and validate transactions based on the number of coins they hold and decide to “stake.” In PoS, users are incentivized to hold their coins in a designated wallet to participate in block validation.

- Validators are selected to create new blocks based on the number of coins they hold and stake.

- Users can participate in staking by locking up a certain amount of coins in a staking wallet.

- Rewards are distributed to validators in proportion to the amount they have staked.

Delegated Proof of Stake (DPoS)

Delegated Proof of Stake (DPoS) is a variant of the PoS consensus algorithm where users can vote for delegates to represent them in block production and validation. These delegates are responsible for creating new blocks and verifying transactions on behalf of the network.

- Users can vote for delegates to represent them in block production and validation.

- Delegates are responsible for creating new blocks and validating transactions on behalf of the network.

- Rewards are distributed to both delegates and voters based on their participation in the network.

Running a Full Node vs. Delegating Tokens

When it comes to staking, users have the option to either run a full node or delegate their tokens to a validator. Running a full node requires more technical expertise and resources, while delegating tokens is a simpler way for users to participate in staking without the need for maintaining a node.

- Running a full node involves hosting a complete copy of the blockchain and actively participating in block validation.

- Delegating tokens allows users to stake their coins with a validator who handles the technical aspects of block validation on their behalf.

- Delegating tokens is a more passive way of earning rewards compared to running a full node.

Platforms and Wallets Supporting Staking

There are several platforms and wallets that support staking for various cryptocurrencies, providing users with the opportunity to earn rewards by participating in staking activities. Some examples include:

- Tezos (XTZ) – Supported by platforms like Coinbase and Binance for staking.

- Cardano (ADA) – Users can stake their ADA coins through wallets like Daedalus and Yoroi.

- EOS (EOS) – DPoS-based staking on platforms such as Greymass and Infinito Wallet.

Rewards and Incentives: Crypto Staking Explained

When it comes to crypto staking, earning rewards and incentives is a key motivation for participants. Staking rewards are a way for users to earn passive income by contributing to the security and operation of a blockchain network through staking their tokens.

Calculating Staking Rewards

Staking rewards are typically calculated based on a combination of factors such as the amount of tokens staked, the duration of the stake, and the overall network performance. The formula for calculating staking rewards may vary depending on the specific blockchain protocol being used.

- Amount of Tokens Staked: The more tokens a user stakes, the higher their potential rewards.

- Duration of Stake: Longer staking periods often result in higher rewards due to the increased security and stability they provide to the network.

- Network Performance: Higher network performance and participation levels can lead to increased rewards for stakers.

Influencing Factors on Rewards

Several factors can influence the rewards earned from staking, including the current market conditions, network congestion, and the specific staking protocol being used. Additionally, the total supply of tokens and the inflation rate of the network can impact the rewards received by stakers.

Additional Incentives for Stakers

In addition to staking rewards, stakers may also receive additional incentives such as governance rights, which allow them to participate in decision-making processes related to the blockchain network. Some protocols also distribute network fees to stakers as an extra reward for their participation.

Maximizing Staking Rewards

To maximize staking rewards, stakers can consider strategies such as diversifying their staking portfolios across multiple networks, choosing staking pools with lower fees, and staying informed about upcoming network upgrades or changes that could affect rewards. It is also important for stakers to regularly monitor their staking activities and adjust their strategies as needed to optimize their returns.

In conclusion, Crypto staking is a dynamic way for investors to earn rewards and actively participate in blockchain networks. By staking your tokens, you not only secure the network but also unlock various incentives and governance rights. Take advantage of this innovative method to maximize your crypto earnings and engage with the future of finance.

Check what professionals state about Cryptocurrency regulations in 2025 and its benefits for the industry.