Kicking off with Understanding forex trading pairs, this opening paragraph is designed to captivate and engage the readers, setting the tone for an in-depth exploration of major, minor, and exotic pairs, as well as currency correlations in the Forex market.

What are Forex trading pairs?

Forex trading pairs refer to the combination of two different currencies that are traded against each other in the foreign exchange market. These pairs are the foundation of forex trading as they represent the value of one currency relative to another.

When trading forex, traders always buy one currency while selling another concurrently. The first currency in the pair is known as the base currency, and the second currency is the quote currency. The value of the pair indicates how much of the quote currency is needed to purchase one unit of the base currency.

Popular Trading Pairs in Forex

In the forex market, there are several popular trading pairs that are widely traded by investors and traders. Some of these include:

- Euro vs. US Dollar (EUR/USD)

- US Dollar vs. Japanese Yen (USD/JPY)

- British Pound vs. US Dollar (GBP/USD)

- Australian Dollar vs. US Dollar (AUD/USD)

These pairs are highly liquid and offer tight spreads, making them attractive to traders.

How Trading Pairs Work and Their Importance

Trading pairs work by showing the exchange rate between two currencies. For example, if the EUR/USD pair is trading at 1.1500, it means that 1 Euro is equivalent to 1.15 US Dollars. Traders can go long (buy) or short (sell) a particular currency pair based on their market analysis and expectations.

The importance of trading pairs in forex trading lies in the fact that they provide opportunities for traders to profit from fluctuations in currency values. By analyzing the factors affecting each currency in the pair, traders can make informed decisions and execute profitable trades.

Major vs. Minor vs. Exotic pairs

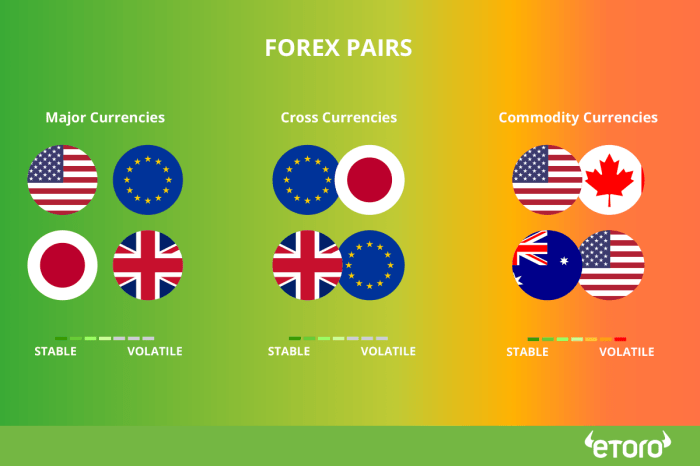

When it comes to Forex trading pairs, they are categorized into three main types: major pairs, minor pairs, and exotic pairs. Each type has its own characteristics and significance in the Forex market.

Major Pairs

Major pairs are the most commonly traded currency pairs in the Forex market. They consist of the most liquid and widely traded currencies, such as the US Dollar (USD), Euro (EUR), Japanese Yen (JPY), British Pound (GBP), Swiss Franc (CHF), Canadian Dollar (CAD), and Australian Dollar (AUD). Major pairs typically have tight spreads and high liquidity, making them popular among traders.

Examples of major pairs include:

– EUR/USD (Euro/US Dollar)

– USD/JPY (US Dollar/Japanese Yen)

– GBP/USD (British Pound/US Dollar)

Minor Pairs

Minor pairs, also known as cross currency pairs, do not include the US Dollar. These pairs are still actively traded but have lower liquidity compared to major pairs. Minor pairs usually involve currencies from developed countries other than the US Dollar.

Examples of minor pairs include:

– EUR/GBP (Euro/British Pound)

– AUD/JPY (Australian Dollar/Japanese Yen)

– GBP/JPY (British Pound/Japanese Yen)

Exotic Pairs

Exotic pairs consist of one major currency and one currency from a developing or emerging market. These pairs are less liquid and have wider spreads compared to major and minor pairs. Exotic pairs are considered riskier due to their volatility and lower trading volume.

Examples of exotic pairs include:

– USD/TRY (US Dollar/Turkish Lira)

– EUR/TRY (Euro/Turkish Lira)

– USD/ZAR (US Dollar/South African Rand)

Understanding the distinctions between major, minor, and exotic pairs is crucial for Forex traders as it can impact trading strategies, risk management, and profit potential. Major pairs are more stable and less volatile, making them suitable for beginners, while exotic pairs require more experience and risk tolerance due to their unpredictable nature.

Base currency and quote currency: Understanding Forex Trading Pairs

When trading forex pairs, it’s essential to understand the concept of base currency and quote currency. The base currency is the first currency listed in a forex pair, while the quote currency is the second one. For example, in the pair EUR/USD, the base currency is the Euro, and the quote currency is the US Dollar.

Representation of base and quote currencies, Understanding forex trading pairs

In a forex pair, the base currency is always represented as 1 unit, while the quote currency shows how much of the quote currency is needed to purchase 1 unit of the base currency. For instance, if the EUR/USD exchange rate is 1.20, it means that 1 Euro can be exchanged for 1.20 US Dollars.

- The base currency is the currency being bought or sold.

- The quote currency is the currency used to make the transaction.

- The exchange rate represents the value of the base currency in terms of the quote currency.

Currency correlations

When trading Forex pairs, it’s essential to understand the concept of currency correlations. Currency correlations refer to the relationship between two currency pairs and how they tend to move in relation to each other.

Positively correlated currency pairs

- One example of positively correlated currency pairs is the EUR/USD and GBP/USD. These pairs tend to move in the same direction, meaning when one pair strengthens, the other pair also tends to strengthen.

- Another example is the AUD/USD and NZD/USD. These pairs also exhibit a positive correlation, moving in tandem most of the time.

Negatively correlated currency pairs

- An example of negatively correlated currency pairs is the USD/JPY and USD/CHF. These pairs move in opposite directions, so when one pair strengthens, the other typically weakens.

- Another example is the EUR/USD and USD/CHF. These pairs tend to have a negative correlation, with movements inversely related to each other.

How understanding currency correlations can help traders

- By understanding currency correlations, traders can diversify their portfolios effectively. They can avoid taking positions in highly correlated pairs to reduce risk.

- Traders can also use currency correlations to hedge their positions. If they have a long position in one pair, they can take a short position in a negatively correlated pair to offset potential losses.

- Moreover, knowing the correlations between pairs can provide insights into the overall market sentiment and help traders make more informed decisions about their trades.

In conclusion, a solid understanding of forex trading pairs is essential for navigating the complex world of Forex trading. By grasping the distinctions between major, minor, and exotic pairs, as well as understanding currency correlations, traders can make more informed decisions to enhance their trading strategies and potential for success in the market.

Remember to click Best crypto tokens to watch to understand more comprehensive aspects of the Best crypto tokens to watch topic.