As How to read forex charts takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original. Here, we delve into the intricate realm of forex chart analysis, unlocking the secrets to deciphering market movements with precision and insight.

In this comprehensive guide, we will explore the fundamental principles behind reading forex charts, equipping you with the essential skills to navigate the dynamic landscape of currency trading effectively.

Introduction to Forex Charts

Understanding forex charts is crucial for traders looking to analyze and interpret market trends effectively. These charts provide valuable insights into the price movements of currency pairs, helping traders make informed decisions.

Types of Forex Charts

There are three main types of forex charts used in trading:

- Line Chart: A basic chart that connects the closing prices of a currency pair over a specific period.

- Bar Chart: Displays the high, low, open, and close prices of a currency pair for a given time frame.

- Candlestick Chart: Offers a more visual representation of price movements, showing the open, close, high, and low prices in a candlestick format.

Key Components of a Forex Chart

A forex chart typically consists of the following key components:

- X-Axis: Represents the time frame or trading period being analyzed.

- Y-Axis: Displays the price levels of the currency pair being traded.

- Candlesticks/Bar Data: Provides information on the open, close, high, and low prices for a specific time interval.

- Chart Patterns: Formations on the chart that traders use to identify potential trend reversals or continuations.

Types of Forex Charts

When it comes to analyzing forex data, there are three main types of charts that traders commonly use: line charts, bar charts, and candlestick charts. Each type has its own advantages and disadvantages, making them suitable for different trading styles and strategies.

Line Charts

Line charts are the most basic type of forex chart and are created by connecting a series of closing prices. They provide a simple visual representation of price movement over time, making it easy to identify trends. However, line charts lack the detail found in other types of charts, such as open, high, and low prices, which can limit their usefulness for in-depth analysis.

Bar Charts

Bar charts display more information compared to line charts, including the open, high, low, and close prices for each period. Each bar represents a specific time frame, with the top of the bar indicating the highest price reached and the bottom showing the lowest price. Bar charts are useful for identifying price ranges and volatility but can be overwhelming for beginners due to the amount of information displayed.

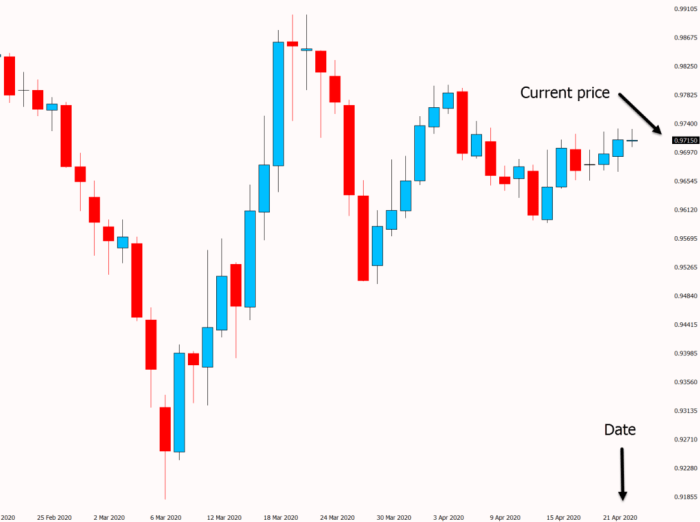

Candlestick Charts

Candlestick charts are widely used by forex traders due to their ability to convey a lot of information in a single bar. Each candlestick represents the open, high, low, and close prices for a specific period, with the body of the candle indicating the open and close prices and the wicks showing the high and low prices. Candlestick charts are excellent for spotting trends, reversals, and patterns, making them a popular choice among traders.

Overall, the choice of forex chart type depends on individual preferences, trading style, and analytical needs. Traders may use a combination of chart types to gain a comprehensive understanding of price movements and make informed trading decisions.

Reading Candlestick Charts: How To Read Forex Charts

Candlestick charts are a popular tool used by forex traders to analyze price movements and make trading decisions. Understanding the elements of a candlestick and recognizing common patterns can help traders predict future price movements.

Elements of a Candlestick

- The body of the candlestick represents the difference between the opening and closing prices during a specific time period. A filled (black or red) body indicates a bearish candle, where the closing price is lower than the opening price. Conversely, an empty (white or green) body represents a bullish candle, where the closing price is higher than the opening price.

- The wick, also known as the shadow, extends from the top and bottom of the body and shows the highest and lowest prices reached during the time period. The length of the wick indicates the price volatility during that period.

- The color of the candlestick provides visual cues about market sentiment. For example, a series of bullish (green/white) candles may indicate an uptrend, while a pattern of bearish (red/black) candles could signal a downtrend.

Common Candlestick Patterns

- Doji: Signifies indecision in the market, often appearing as a cross or plus sign. Traders may interpret this as a potential reversal point.

- Hammer: A bullish reversal pattern characterized by a short body and long lower wick, indicating potential buying pressure after a downtrend.

- Engulfing: A two-candle pattern where the second candle completely engulfs the body of the previous candle. This could signal a reversal in the current trend.

Using Candlestick Patterns for Decision-Making

- Traders use candlestick patterns to identify potential entry and exit points in the market. For example, a bullish engulfing pattern after a downtrend may indicate a buying opportunity.

- Combining candlestick patterns with other technical indicators can help confirm trading signals and improve decision-making accuracy.

- It is essential to consider the overall market context and not rely solely on candlestick patterns for trading decisions. Risk management and proper analysis are crucial for successful trading.

Understanding Technical Indicators on Charts

Technical indicators play a crucial role in analyzing forex charts by providing insights into market trends and potential reversals. Traders use indicators like RSI, MACD, and Bollinger Bands to make informed trading decisions based on historical price data.

In this topic, you find that How to avoid crypto scams is very useful.

Purpose of Technical Indicators

Technical indicators are mathematical calculations plotted on forex charts to help traders identify market trends and patterns. They are designed to provide a visual representation of market conditions and assist in predicting future price movements.

- Relative Strength Index (RSI): Measures the speed and change of price movements to determine overbought or oversold conditions in the market.

- Moving Average Convergence Divergence (MACD): Shows the relationship between two moving averages to signal changes in momentum and potential trend reversals.

- Bollinger Bands: Consist of a moving average and two standard deviation bands to indicate volatility and potential price breakouts.

Using Indicators to Confirm Trends or Signal Reversals

Traders can use technical indicators to confirm the strength of a trend or anticipate a reversal in the market. For example, if the RSI is above 70, it suggests the market is overbought and may reverse soon. Conversely, an RSI below 30 indicates oversold conditions and a potential reversal to the upside.

Combining Multiple Indicators for Better Analysis

By combining different technical indicators, traders can enhance their analysis and make more informed trading decisions. For instance, using both MACD and Bollinger Bands can provide a comprehensive view of market momentum and volatility, helping traders identify optimal entry and exit points.

Interpreting Support and Resistance Levels

Support and resistance levels are crucial concepts in forex trading as they help traders identify potential price points where the market may reverse or continue its current trend. Support refers to a price level where a currency pair tends to find buying interest, preventing it from falling further. On the other hand, resistance is a price level where a currency pair tends to encounter selling pressure, preventing it from rising further.

Identifying Support and Resistance Levels

Support and resistance levels can be identified by looking at historical price data on a forex chart. Traders typically look for areas where the price has reversed multiple times in the past, creating a horizontal line on the chart. These levels can act as barriers that the price struggles to break through, indicating strong buying or selling pressure at those points.

- Support levels are often seen as floors where the price bounces off and heads higher, indicating a potential buying opportunity.

- Resistance levels are viewed as ceilings where the price struggles to break through and may reverse lower, presenting a potential selling opportunity.

It is important to note that support and resistance levels are not exact prices but rather zones within which the price tends to react.

Significance of Support and Resistance in Trading

Support and resistance levels play a significant role in making trading decisions. Traders can use these levels to:

- Determine entry and exit points for trades based on price reactions at these levels.

- Set stop-loss orders to manage risk by placing them beyond support or resistance levels.

- Identify potential breakout or reversal points in the market.

By understanding and interpreting support and resistance levels on forex charts, traders can enhance their decision-making process and improve their overall trading performance.

Utilizing Chart Timeframes

When analyzing forex charts, the choice of timeframe plays a crucial role in determining trading decisions. Different timeframes, such as daily, weekly, and hourly, offer unique perspectives on price movements and trends in the market.

Importance of Different Timeframes, How to read forex charts

Each timeframe provides a varying level of detail about price action, allowing traders to zoom in or out on market dynamics. The daily timeframe offers a broader view of the market trends over a longer period, while the hourly timeframe provides more granular insights into short-term price movements.

It is essential to consider multiple timeframes to get a comprehensive understanding of the market and make informed trading decisions.

Choosing the Right Timeframe

Traders should select the timeframe that aligns with their trading style and objectives. For long-term investors, the weekly or daily charts may be more suitable, whereas day traders might focus on the hourly or even shorter timeframes for quick trades.

Using Multiple Timeframes for Analysis

One effective strategy is to use multiple timeframes simultaneously to confirm trends and identify potential entry and exit points. For example, traders can use a combination of daily and hourly charts to validate signals and ensure a more robust trading strategy.

Applying Trendlines on Forex Charts

When analyzing forex charts, trendlines play a crucial role in identifying trends and potential trading opportunities. By drawing trendlines correctly on a chart, traders can visually represent the direction of price movement and make informed decisions based on these patterns.

Defining Trendlines and Their Role

Trendlines are diagonal lines that connect two or more price points on a chart, showing the direction of a trend. They can be used to identify both upward (bullish) and downward (bearish) trends in the market. Trendlines act as dynamic levels of support and resistance, guiding traders on possible entry and exit points.

Drawing Trendlines Correctly

When drawing trendlines, it is important to connect the significant swing lows in an uptrend or swing highs in a downtrend. This helps in capturing the overall trend direction and establishing a clear visual representation of price movements. Remember to avoid forcing trendlines to fit the data and instead focus on aligning with the most relevant price points.

Using Trendlines for Entry and Exit Points

Trendlines can be utilized by traders to determine potential entry and exit points for trades. In an uptrend, traders may look for buying opportunities near the trendline support, while in a downtrend, selling opportunities may arise near the trendline resistance. Breakouts above or below trendlines can signal potential trend reversals or continuations, providing valuable insights for decision-making.

In conclusion, mastering the art of reading forex charts is a valuable skill that can elevate your trading strategies to new heights. By understanding the intricacies of chart analysis, you can make informed decisions and seize opportunities in the ever-evolving forex market. Dive into the world of forex charts with confidence, armed with the knowledge to interpret trends and patterns with clarity and precision.