How to trade altcoins sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with ahrefs author style and brimming with originality from the outset.

Understanding the world of altcoins, exploring trading strategies, choosing the right exchanges, and delving into technical analysis are all part of the exciting journey that awaits in the world of cryptocurrency trading.

Understanding Altcoins

Altcoins, short for alternative coins, refer to any cryptocurrency other than Bitcoin. They serve as alternatives to Bitcoin and have their own unique features and functionalities that differentiate them from the original cryptocurrency.

Popular Altcoins and Their Unique Features

- Ethereum: Known for its smart contract functionality, allowing developers to build decentralized applications on its blockchain.

- Ripple (XRP): Primarily used for cross-border payments and settlement, offering fast and low-cost transactions.

- Litecoin: Positioned as the silver to Bitcoin’s gold, with faster transaction speeds and lower fees.

Differences Between Altcoins and Bitcoins

- Technology: Altcoins often implement different technologies and algorithms, such as proof-of-stake (PoS) or proof-of-authority (PoA), as opposed to Bitcoin’s proof-of-work (PoW) consensus mechanism.

- Use Cases: Altcoins may have specific use cases or functionalities that cater to different industries or applications, while Bitcoin is primarily seen as a store of value or digital gold.

- Market Cap: Bitcoin typically dominates the cryptocurrency market in terms of market capitalization, while altcoins may have varying market shares based on their popularity and adoption.

Altcoin Trading Strategies: How To Trade Altcoins

When it comes to trading altcoins, there are various strategies that traders can employ to maximize their profits and minimize risks. It is essential to have a clear trading plan in place before diving into the volatile world of altcoin trading.

Day Trading

Day trading involves buying and selling altcoins within the same trading day to take advantage of short-term price fluctuations. This strategy requires constant monitoring of the market and quick decision-making. Day traders aim to make small profits on multiple trades throughout the day.

Swing Trading, How to trade altcoins

Swing trading is a strategy that involves holding altcoins for a few days to weeks to capitalize on medium-term price movements. Unlike day trading, swing traders are not as concerned with intraday price fluctuations and focus more on capturing larger price swings.

Long-Term Holding

Long-term holding, also known as “HODLing,” involves buying altcoins with the intention of holding them for an extended period, usually months or years. This strategy is based on the belief that the value of the altcoin will increase significantly over time. Long-term holders are less concerned with short-term price fluctuations and focus on the overall growth potential of the altcoin.

Setting Stop-Loss Orders and Profit Targets

It is crucial for altcoin traders to set stop-loss orders to limit potential losses in case the market moves against their position. Additionally, establishing profit targets helps traders lock in profits and avoid getting greedy. These risk management tools are essential for successful altcoin trading.

Risks Associated with Altcoin Trading vs. Traditional Stocks

Trading altcoins comes with unique risks compared to trading traditional stocks. Altcoins are known for their high volatility, which can result in significant price fluctuations in a short period. On the other hand, traditional stocks tend to be more stable and less prone to extreme price swings. Altcoin traders must be prepared for the high levels of risk and uncertainty associated with the cryptocurrency market.

Choosing the Right Altcoin Exchange

When it comes to trading altcoins, choosing the right exchange is crucial. Factors such as fees, security, user interface, and available altcoin options can significantly impact your trading experience. Here are some key points to consider:

Factors to Consider

- Fees: Look for exchanges with competitive fees to ensure you are not losing a significant portion of your profits to trading fees.

- Security: Prioritize exchanges with robust security measures such as two-factor authentication (2FA) and cold storage for funds.

- User Interface: Opt for exchanges with user-friendly interfaces that make trading easy and intuitive.

- Available Altcoin Options: Choose exchanges that offer a wide range of altcoins to trade, allowing you to diversify your portfolio.

Tips for Safe Altcoin Storage

- Use Personal Wallets: Consider storing your altcoins in personal wallets rather than leaving them on exchanges to reduce the risk of hacking or theft.

- Backup Your Wallet: Always back up your wallet’s private keys and store them securely to ensure you can access your funds in case of emergencies.

- Enable Two-Factor Authentication: Add an extra layer of security to your exchange accounts by enabling two-factor authentication to protect your funds.

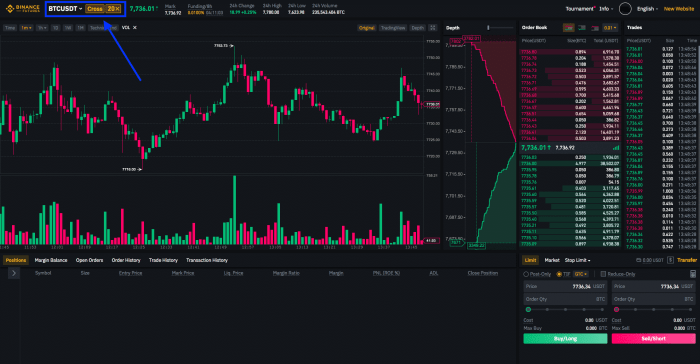

Technical Analysis for Altcoin Trading

When it comes to trading altcoins, technical analysis plays a crucial role in making informed decisions. By analyzing historical price data, traders can identify patterns and trends that may help predict future price movements. In this section, we will explore some key technical analysis tools and indicators used in altcoin trading, as well as how to read price charts and understand the significance of volume and liquidity.

Key Technical Analysis Tools and Indicators

- Moving Averages: Moving averages help smooth out price data to identify trends over a specific period. Traders often use the 50-day and 200-day moving averages to determine potential entry and exit points.

- Relative Strength Index (RSI): The RSI measures the speed and change of price movements. It indicates whether an altcoin is overbought or oversold, helping traders assess potential reversals.

- Bollinger Bands: Bollinger Bands consist of a simple moving average and two standard deviations above and below the average. Traders use them to identify volatility and potential price breakouts.

Reading Altcoin Price Charts and Identifying Trends

- Support and Resistance Levels: Support levels indicate where the price tends to find a bottom, while resistance levels show where it struggles to move above. Traders look for breakouts or bounces at these levels.

- Candlestick Patterns: Candlestick patterns reveal market sentiment and can indicate potential reversals or continuations. Patterns like doji, hammer, and engulfing patterns are commonly used in altcoin trading.

- Trendlines: Drawing trendlines helps identify the direction of the trend. Traders look for higher highs and higher lows in an uptrend, or lower highs and lower lows in a downtrend.

Significance of Volume and Liquidity

- Volume: Volume shows the number of altcoins traded within a specific period. High volume often indicates strong market interest and validates price movements, while low volume may signal a lack of conviction.

- Liquidity: Liquidity refers to how easily an altcoin can be bought or sold without significantly impacting its price. Altcoins with higher liquidity are usually preferred by traders, as they allow for smoother execution of trades.

As we conclude this guide on how to trade altcoins, it’s evident that mastering the art of altcoin trading requires a combination of knowledge, strategy, and a keen eye for trends. By implementing the insights gained here, you’ll be better equipped to navigate the dynamic landscape of altcoin trading with confidence and success.

Enhance your insight with the methods and methods of Luxury electric sports cars.