Forex brokers comparison is a crucial step in choosing the right broker for your trading needs. From regulatory compliance to trading platforms, this guide will help you navigate the complexities of the forex market with ease.

Whether you’re a beginner looking to get started or an experienced trader seeking better opportunities, understanding the key factors in comparing forex brokers is essential for success.

Factors to Consider When Comparing Forex Brokers

When comparing forex brokers, there are several key factors to take into consideration to ensure you choose the right one for your trading needs.

Regulatory Compliance

Regulatory compliance is crucial when selecting a forex broker. You should always choose a broker that is regulated by a reputable financial authority in their jurisdiction. This helps to ensure the safety of your funds and protects you from fraudulent activities.

Trading Platforms

One of the key differences between forex brokers is the trading platforms they offer. The trading platform is where you will execute your trades, so it is important to choose a broker that offers a platform that is user-friendly, reliable, and suits your trading style.

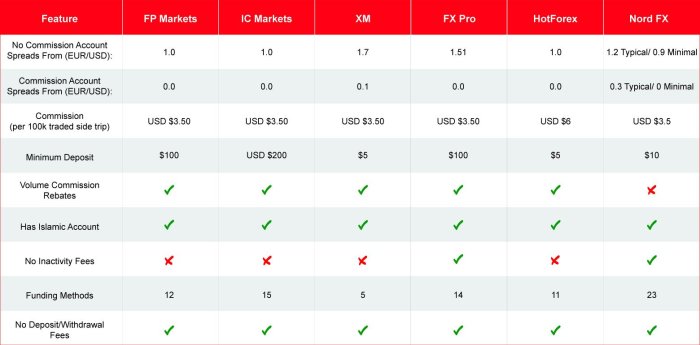

Spreads and Fees

Another important factor to consider when comparing forex brokers is the spreads and fees they charge. Spreads refer to the difference between the buy and sell price of a currency pair, and lower spreads can help you save on trading costs. It is also essential to consider any other fees, such as commissions or overnight fees, that may apply.

Customer Support Options, Forex brokers comparison

Lastly, consider the customer support options provided by the forex brokers you are comparing. Having access to responsive and helpful customer support can make a big difference, especially in times of technical difficulties or when you need assistance with your trading account.

Types of Trading Accounts Offered: Forex Brokers Comparison

When comparing forex brokers, it is essential to consider the types of trading accounts they offer. These accounts can vary in terms of features, benefits, and requirements, so understanding the differences can help you choose the one that best suits your trading needs.

Standard Accounts

Standard trading accounts are the most common type offered by forex brokers. These accounts typically have higher minimum deposit requirements but offer lower leverage compared to other account types. Standard accounts are suitable for beginner traders who prefer a more conservative approach to trading.

Mini Accounts

Mini accounts are designed for traders who have limited capital to invest. These accounts require a lower minimum deposit compared to standard accounts and often offer higher leverage. Mini accounts are ideal for traders who want to test the waters of forex trading without risking a significant amount of capital.

Micro Accounts

Micro accounts are even smaller in size than mini accounts, with the lowest minimum deposit requirements. These accounts usually offer the highest leverage, making them attractive to traders who want to trade with a very small amount of capital. Micro accounts are suitable for those who are just starting out in forex trading and want to practice their strategies with minimal risk.

ECN Accounts

ECN (Electronic Communication Network) accounts are designed for advanced traders who require direct access to the interbank market. These accounts offer tight spreads but often come with higher commission fees. ECN accounts are preferred by professional traders who rely on fast execution speeds and transparency in pricing.

Impact of Account Types on Trading Strategies

The type of trading account you choose can significantly impact your trading strategies. For example, higher leverage offered by mini and micro accounts can amplify both profits and losses, so it is crucial to manage risk effectively. Standard accounts, on the other hand, provide a more conservative approach with lower leverage, which may be more suitable for long-term trading strategies.

Minimum Deposit Requirements

Minimum deposit requirements vary depending on the type of trading account. Standard accounts usually have higher minimum deposit requirements, while mini and micro accounts offer lower entry barriers. ECN accounts may have the highest minimum deposit requirements due to the advanced features and direct market access they provide.

Overall, understanding the different types of trading accounts offered by forex brokers and their respective features can help you make an informed decision based on your trading goals and risk tolerance.

Trading Instruments and Markets

When comparing forex brokers, it is essential to consider the range of trading instruments and markets they offer. This can significantly impact your trading opportunities and flexibility as an investor.

Financial Instruments Available for Trading

- Currency pairs: The most common instruments in forex trading, allowing you to trade on the exchange rate between two currencies.

- Stocks: Some brokers offer the option to trade shares of publicly traded companies.

- Commodities: Including precious metals like gold and silver, as well as agricultural products like wheat and corn.

- Indices: Representing a group of stocks that measure the performance of a specific market or sector.

Range of Markets Offered

- Forex market: The largest financial market in the world, where currencies are traded.

- Stock markets: Including major exchanges like the NYSE and NASDAQ.

- Commodity markets: Where traders can access various commodities for trading.

- Indices markets: Providing exposure to different stock market indices.

Impact of Access to Different Markets

Access to a diverse range of markets can provide traders with more opportunities for profit and risk management. For example, trading in different markets allows for portfolio diversification, reducing the overall risk of a trader’s investments.

Availability of Cryptocurrencies for Trading

- Some brokers offer the option to trade popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

- Cryptocurrency trading can provide additional trading opportunities and exposure to a volatile and rapidly evolving market.

- However, it is essential to consider the risks associated with cryptocurrency trading, as prices can be highly volatile.

Research and Analysis Tools

When comparing forex brokers, one crucial aspect to consider is the research and analysis tools they provide to traders. These tools can significantly impact a trader’s decision-making process and overall trading experience.

Quality of Market Research and Analysis

The quality of market research and analysis offered by forex brokers can vary significantly. Some brokers provide in-depth market analysis, including technical and fundamental analysis, economic calendars, and expert insights. Others may offer basic research tools or none at all. Traders should look for brokers that offer comprehensive research tools to stay informed and make well-informed trading decisions.

- Brokers with high-quality research tools often provide daily market updates, analysis reports, and trading signals.

- Access to advanced charting tools, real-time market data, and trading indicators can also enhance a trader’s analytical capabilities.

- Some brokers offer access to third-party research platforms or partnerships with financial news providers to deliver timely market insights.

Educational Resources for Traders

In addition to research tools, educational resources play a vital role in a trader’s development and success. Forex brokers that offer comprehensive educational materials, such as webinars, tutorials, trading guides, and demo accounts, can help traders improve their skills and knowledge.

- Access to educational webinars and seminars conducted by market experts can provide valuable insights into trading strategies and market trends.

- Brokers that offer demo accounts allow traders to practice trading in a risk-free environment and test different strategies before committing real funds.

- Comprehensive trading guides and tutorials on technical analysis, risk management, and trading psychology can help traders enhance their trading skills.

Importance of Real-Time Data and News Updates

Real-time data and news updates are essential for traders to stay informed about market developments and make timely trading decisions. Brokers that provide access to real-time market data, economic news releases, and financial updates can help traders react quickly to market events.

Timely news updates can impact currency prices and market volatility, making real-time data crucial for traders.

- Brokers that offer access to financial news feeds, economic calendars, and market analysis tools can help traders stay ahead of market movements.

- Real-time data on currency pairs, commodities, and indices can enable traders to spot trading opportunities and make informed decisions.

- Integration with trading platforms that offer live market data and news updates can enhance a trader’s ability to react swiftly to changing market conditions.

Payment Methods and Withdrawal Processes

When comparing forex brokers, it is essential to consider the payment methods accepted and the withdrawal processes in place. These factors can significantly impact your trading experience and overall efficiency in managing your finances.

Payment Methods Accepted

- Brokers may accept various payment methods, including bank transfers, credit/debit cards, e-wallets, and cryptocurrencies.

- Some brokers may have limitations on certain payment methods or charge fees for specific options.

- Consider the convenience, speed, and security of each payment method when choosing a broker.

Withdrawal Processes and Fees

- Brokers have different withdrawal processes, including processing times and verification requirements.

- Some brokers may charge withdrawal fees or have minimum withdrawal amounts.

- Ensure you understand the withdrawal procedures and any associated fees before opening an account with a broker.

Security Measures for Financial Transactions

- Look for brokers that offer secure payment gateways and encryption protocols to protect your financial information.

- Verify that the broker complies with regulatory standards and has measures in place to prevent fraud and unauthorized transactions.

- Consider the reputation and reliability of the broker in safeguarding your funds and personal data.

Impact of Payment Options on Trading Efficiency

- The choice of payment method can affect the speed of deposits and withdrawals, which can impact your ability to react quickly in the forex market.

- Consider the costs associated with different payment options and how they may impact your overall trading costs and profitability.

- Efficient payment processes can help you focus on your trading strategy without being hindered by delays or complications in managing your funds.

In conclusion, conducting a thorough comparison of forex brokers can lead to better trading decisions and improved profitability. By considering factors like account types, trading instruments, research tools, and payment methods, you can find the perfect broker to support your trading goals.

Check Best crypto trading platforms to inspect complete evaluations and testimonials from users.